So as I travel around these global conferences, startup challenges and Fintech daze, I often get asked: what does it take to be a Fintech centre? This is because everyone wants to be one now that they’ve seen the buzz around the market. London has vied to be that centre for some time, with Boris and Dave roadshows dating back to the start of the decade and Silicon Roundabout being positioned adjacent to the City after key decisions a decade ago.

London likes to have this jockeying position as being the best Fintech centre, but it’s not quite reality. New York created Silicon Alley in 1995 and has 300,000 people employed in tech; London has around 250,000 people employed in the Silicon Roundabout, also known as Tech City, and has rapidly become the third largest technology hub globally after New York and Silicon Valley.

This does then lead to jockeying for position – who’s the best Fintech hub – and a lot of other cities trying to muscle in on the action. For some time, I’ve seen Sydney, Hong Kong and Singapore as vital centres in Asia to join our clan, but am intrigued to find cities like Tel Aviv, Istanbul, Dubai and Moscow on my list, and those aren’t easy partners. In fact, most cities that have a bank have some sort of Fintech position, with banks like BBVA and Santander creating real impetus from Barcelona to Sao Paolo for the Spanish and Portuguese markets. But it still comes back to London, New York and Silicon Valley as the rock stars of Fintech.

As a result of this jockeying for position, the UK Gov had their Fintech Week last week. I wasn’t invited till the last minute as they had no idea I knew anything about Fintech I guess – honest omission – but they then released a slightly biased report by Ernst & Young, that was meant to show London as the top Fintech centre of the world. The key facts highlighted included:

- The UK FinTech sector attracted c.£524m in investment in 2015, and employs a FinTech workforce of c.61,000, second only to California which employs a FinTech workforce of c.74,000.

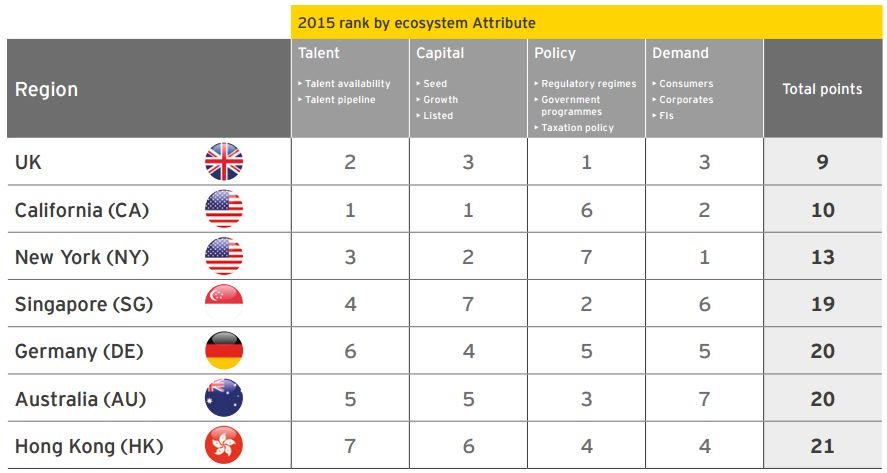

- The UK also ranks first as having the strongest FinTech ecosystem based on our benchmarking exercise. A particular competitive advantage is its world-leading FinTech policy environment. This stems from the supportiveness of regulatory initiatives, tax incentives, and government programmes designed to promote competition and innovation.

- The UK ranks second for its availability of technical, financial services (FS) and entrepreneurial talent across benchmarked regions. It is particularly noted for its unrivalled access to financial expertise, employing c.1.2m people in FS.

- California dominates FinTech investment with c.£3.6b invested in 2015. The UK appears to have robust access to early-stage capital, although growth capital appears constrained.

- The UK has an enviable position in FinTech today. However, we see strong competition from emerging FinTech hubs that are implementing progressive policy initiatives, and specialising in disruptive technologies. Countries such as China are rapidly scaling up across the sector.

The slight bias for me was that the report compared Countries (UK, Germany, Australia) and Cities (New York, Hong Kong, Singapore), but nevertheless the obvious position is that the UK believes it’s #1 in Fintech and EY endorsed this view (for a small fee).

Now I am also biased and will also say that London is the #1 Fintech Centre, but it’s not based upon a report. It’s based upon an environment. As I travel to New York, Washington and Silicon Valley, I get the sense that the US has a great Fintech buzz, but I don’t get the sense that it’s well aligned. For example, after the glitches in IPOs for Facebook and others, many Silicon Valley firms have an open and active resentment of Wall Street. There’s a them and us about the two coastal hubs. That friction exists in London but the fact that the geeks sit alongside the suits means that this friction gets resolved. That doesn’t happen in the US where Wall Street and Silicon Valley sit 3,000 miles apart.

Similar, when the suits hear the geeks say Eureka, they automatically think: “the regulator won’t allow it”. Believe me, it’s true. However, in London, the regulator is often in the room so they can talk about whether they will allow it or not. Not so in the USA, where the regulators sit in Washington, miles from both the banks and the technologists.

This is why London wins out for me because we have the financial system, the technology infrastructure, the regulatory regime and the government sitting side-by-side to make this work. Add into the mix all the ancillary skills from audit to compliance to accounting to legal to advisory and you have the perfect single centre with everything side-by-side.

And that’s my answer when people ask me: how do we become a Fintech hub? I say that you have to have the support of the government to create the platform; the investment community to finance the platform; the financial community to use the platform; and the technology community to build the platform; at a minimum. If you have those four stars aligned, then the world is your lobster.

That’s why Tel Aviv, Istanbul, Amsterdam and others are in the mix.

Meantime, back to UK Gov who are not sitting on their hands complacently gloating over their perceived #1 position. For the future, the government has laid out a continuation of its plans as follows:

- Create a FinTech “delivery body” to drive high impact policy initiatives to implementation as quickly as possible

- Build on the FCA’s position as the most progressive regulatory body globally

- Deliver practical business support to FinTechs

- Build FinTech “bridges” to support UK FinTechs expand internationally

- Strengthen the UK’s talent pipeline, particularly for tech talent

- Establish regional Centres of Excellence in the UK

- Initiate investor-focused programmes to improve access to growth capital

- Broaden tax initiatives to drive greater investment in UK FinTech

- Promote government, consumer and FI adoption of FinTech services

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...