The Cambridge Centre for Alternative Finance (CCAF) has published its first study on digital currencies, its usage and the emerging ecosystem supporting the new type of currency. As the report explains, “the world of money and finance is transforming before our eyes.”

The “Global Cryptocurrency Benchmarking Study” is CCAF’s inaugural research focused on alternative payment systems and digital assets. Led by Dr. Garrick Hileman, the research is designed to “holistically” examine the global cryptocurrency market and, according to CCAF, is the first of its kind. Michel Rauchs, a Research Assistant at CCAF, co-authored the report.

The “Global Cryptocurrency Benchmarking Study” is CCAF’s inaugural research focused on alternative payment systems and digital assets. Led by Dr. Garrick Hileman, the research is designed to “holistically” examine the global cryptocurrency market and, according to CCAF, is the first of its kind. Michel Rauchs, a Research Assistant at CCAF, co-authored the report.

Dr. Hileman told Crowdfund Insider;

Dr. Hileman told Crowdfund Insider;

“The data we collected indicate that the number of people actively using cryptocurrency is much greater than many people previously thought. Many observers felt that fewer than a million individuals actively use cryptocurrency, but our data suggest that today there are likely well over a million active individuals using cryptocurrency.”

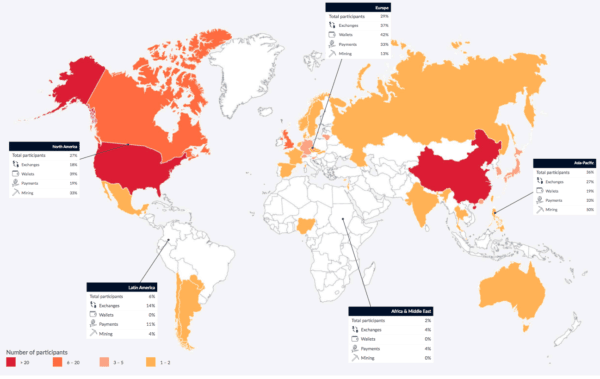

The Global Cryptocurrency Benchmarking Study gathered data from more than 100 cryptocurrency companies in 38 countries around the world via secure web-based questionnaires. CCAF said they captured an estimated 75% of the cryptocurrency industry. Over 30 individual cryptocurrency miners were also surveyed. Four key areas were targeted including exchanges, wallets, mining, and payments.

Highlights of the CCAF research include:

- The exchanges sector has the most operating entities and employs the most people, with significant geographic dispersion. Currently, about 52% of small exchanges hold a formal government license, compared to only 35% of large exchanges. CCAF says recent moves by the People’s Bank of China could soon alter this picture.

- Between 5.8 million and 11.5 million wallets are estimated to be “active” today. If the average person has two wallets, this means there are between 2.9 million and 5.8 million individual active users of cryptocurrency. Approximately 52% of wallets providing an integrated currency exchange feature.

While 79% of cryptocurrency payment companies have relationships with banking institutions and payment networks, the difficulty of obtaining and maintaining these relationships is cited as the biggest challenge by this sector. National-to-cryptocurrency payments constitute two-thirds of total payment company transaction volume, with national-to-national at 27% and cryptocurrency-to-cryptocurrency at 6%.

While 79% of cryptocurrency payment companies have relationships with banking institutions and payment networks, the difficulty of obtaining and maintaining these relationships is cited as the biggest challenge by this sector. National-to-cryptocurrency payments constitute two-thirds of total payment company transaction volume, with national-to-national at 27% and cryptocurrency-to-cryptocurrency at 6%.- Publicly known mining facilities are geographically dispersed, with a significant concentration in certain Chinese provinces. About 75% of all major mining pools are based in China and the US.

- Regarding employment, the study said about 1800 individuals are working full time in the cryptocurrency industry.

- A considerable number of miners seem to be indifferent as to how cryptocurrencies should be treated for tax purposes, but individual miners who are not indifferent would like to see cryptocurrencies being treated as currencies for tax purposes.

- A major concern of both small and large miners is the debate about how a cryptocurrency system should scale, and what methods should be used.

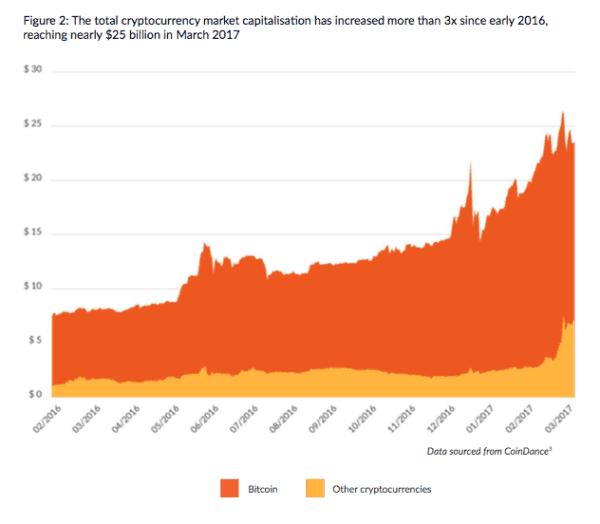

Dr. Hileman said that digital currencies like Bitcoin are not a passing fad. The combined market value was estimated at $27 billion. Hileman compared it to the value creation of a high-profile startup like AirBnB.

While Bitcoin may be the first and best-known cryptocurrency to emerge there are now hundreds of different types of digital coinage. Bitcoin does remain the dominant cryptocurrency both in terms of market capitalisation and usage but it has conceded market share to other cryptocurrencies – declining from 86% to 72% in the past two years. This was buttressed by the fact that almost 40% of wallets accept various forms of cryptocurrencies.

Emerging cryptocurrencies include; Ethereum, Dash, Monero, Ripple and Litecoin.

“This benchmarking study sheds light on the burgeoning cryptocurrency industry and comprehensively examines the global development of exchanges, wallets, payments and mining sectors,” added Robert Wardrop, co-founder and a Director of CCAF. “It demonstrates that cryptocurrencies such as bitcoin are undergoing some profound changes in how digital assets are transacted, stored, channeled and generated. The findings of this study will serve to advance useful academic and policy research into cryptocurrencies and its many implications.”

A forthcoming report will focus on Blockchain or distributed ledger technology (DLT) will also be released in the next few weeks.

The Global Cryptocurrency Benchmarking Study is available here.