I’ve regularly got into confrontations with digital currency people, especially those who are believers in bitcoin, by saying things they don’t like to hear. First it was my comment that you can’t have money without government. They believe the currency is beyond control because it exists on a global network. My contention is that money is a control mechanism used by governments to manage their economies, and that money without government is a bit like animals being able to achieve reproduction without sex. It just doesn’t work, unless you’re a shark. So yes, there may be exceptions to rules, but the rules generally work and what will happen with bitcoin is that governments will find ways to monitor how they’re used and will track and trace them. It’s not anonymous and even if you run a democratised network, there’s always ways to give yourself away, such as not listening to your friends when they tell you, you’re being stupid.

Anyways, I’ve only gone and done it again. I was recently interviewed for Crush the Street and made the comment that bitcoin illustrates the extraordinary madness of crowds brilliantly. I wasn’t saying bitcoin is an invalid currency or that it’s a false god; just that it’s a rollercoaster of ups and downs.

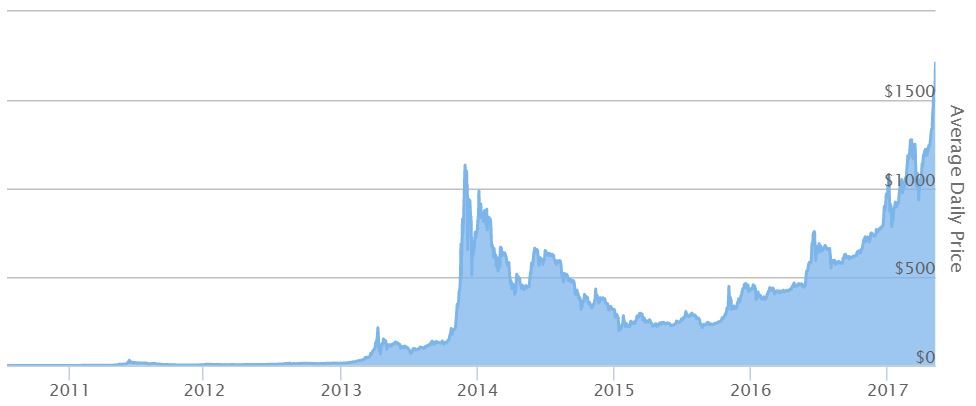

Here’s the bitcoin price over the last eight years:

Source: 99bitcoins

And it’s performance has been pretty strong:

In particular, the bitcoinistas took exception to my comment: “don’t hold your bitcoins”. I made this comment five minutes into the Crush the Street chat, and the reaction has been incredibly negative:

Did chris say "dont hold them" about cryptos... thats the most retarded thing i have heard come out of a a "consultant".... ihave been holding cryptos for years... best financial decision that i made in my entire life ;)

" Don't hold them for too long.. these crypto currencies won't hold their value for long... I hold Gold in its Digital form (GLD).." The MOST retarded "Consultant" comment I have never heard.. This gentleman obviously do not understand "the problem" here and for sure DO NOT understand the true value of BTC / ether etc.. Great to hear a lot of stupidity around..

These are joined by other bitcoinista style commentary, such as:

Bitcoin is not in a bubble. The chart looks like a perfect growing bull market chart. It's just crazy to think crypto currencies won't totally change the rules of the game in banking. Especially once the old system crashes.

Decentralization will cripple the already debt overloaded Banks. This is all just a matter of time now, once the derivative and bond markets start to collapse the game will become very interesting. Like the old saying goes...."when the tide goes out, we'll see who's naked".

Well, it’s going to be interesting to see where this goes, as I’m not a bitcoinista, but I do buy and sell bitcoins (and ether and more). It’s a great way to make a quick buck. So when I said don’t hold them, what I actually meant is by all means buy some bitcoins ... but sell them when you’re happy with the money you make on them. Wait for a while, when the next bear run rolls over it, and buy some more again.

This is a method of making millions whilst not being caught in the bubble when and if it bursts. For example, bitcoin is approaching the $2,000 mark at the moment after running for ages around the $500 mark. I know there will be a correction on that price and have currently sold all my bitcoins. I’m happy with today’s price. I know it’s likely to halve in the next few months, and that’s when I’ll come back in and buy some more again. In fact, in general, whenever the currency triples I sell and whenever it halves I buy. That’s not a bad strategy in my view.

Of course, you could hold them for as long as you want, but that’s purely because you’re a bitcoin believer and are convinced it will never get regulated by governments. I remain to be convinced.

Here’s the full Crush the Street chat for those who want to hear it:

POSTSCRIPT: this blog’s title was stolen from David Birch

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...