The COVID-19 pandemic has brought to a head the importance of a digital economy. In this context, competition is set to accelerate in the fintech sector as the digital shift will make stakeholders fight for market share, according to tech advisory and investment firm GP Bullhound.

In its latest market report on the fintech space, the firm gives insights on COVID-19’s impact on fintech, exploring which sub sectors are likely to be impacted more than others.

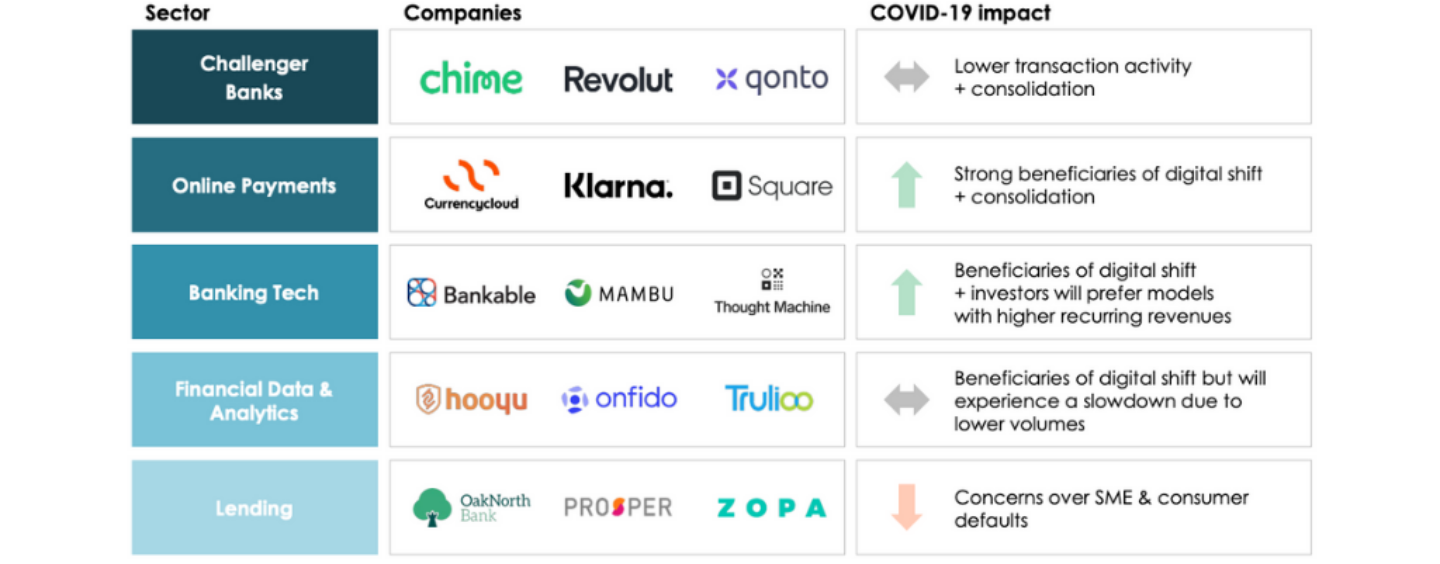

According to the report, though COVID-19 has and will continue to be a challenge for all fintech participants, some sub-sectors, including banking software-as-a-service (SaaS), know-your-customer (KYC)/anti-money laundering (AML) technologies, and machine learning (ML)/artificial intelligence (AI), will likely benefit from the increased shift to a digital economy.

So-called fintech enablers could witness a spike as the urgency of digitalization becomes more evident.

The impact of COVID-19 on the fintech sector, Q1 2020 Sector Update Fintech, GP Bullhound, April 2020

This trend will be noticeable on share prices with verticals that include financial data and analytics, as well as some payments players, expected to trade relatively well throughout this period, the report says.

A toll on fintech markets

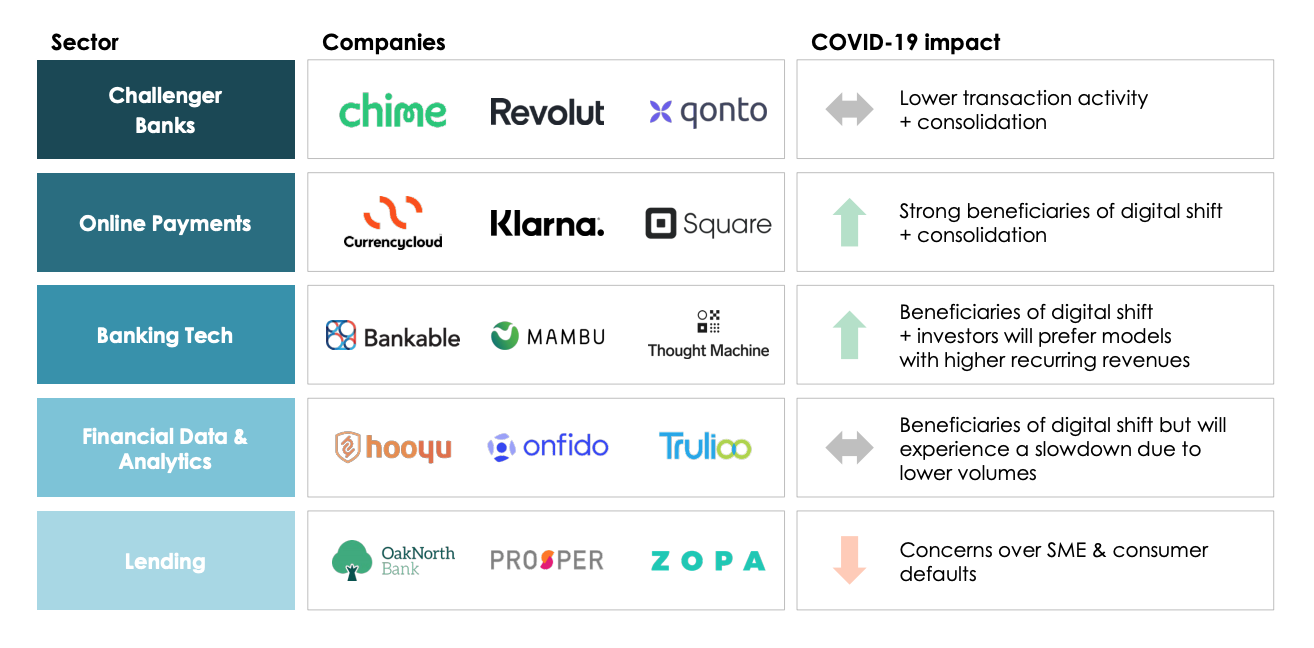

Overall, the COVID-19 crisis and the resulting consequences have put a toll on fintech markets, with valuations currently below the three-year average, the report says.

Fintech valuations are currently below the 3-year average, Q1 2020 Sector Update Fintech, GP Bullhound, April 2020

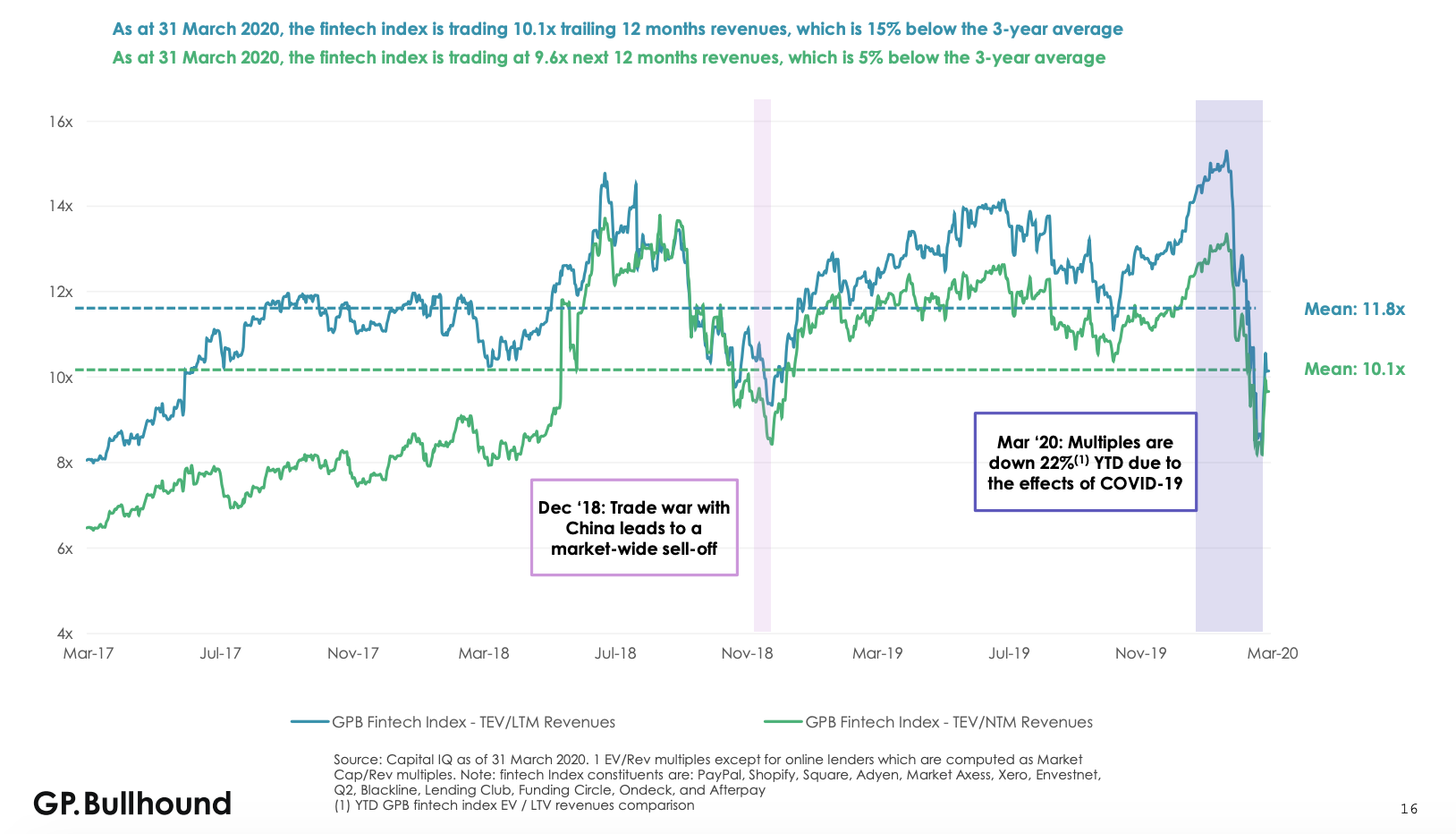

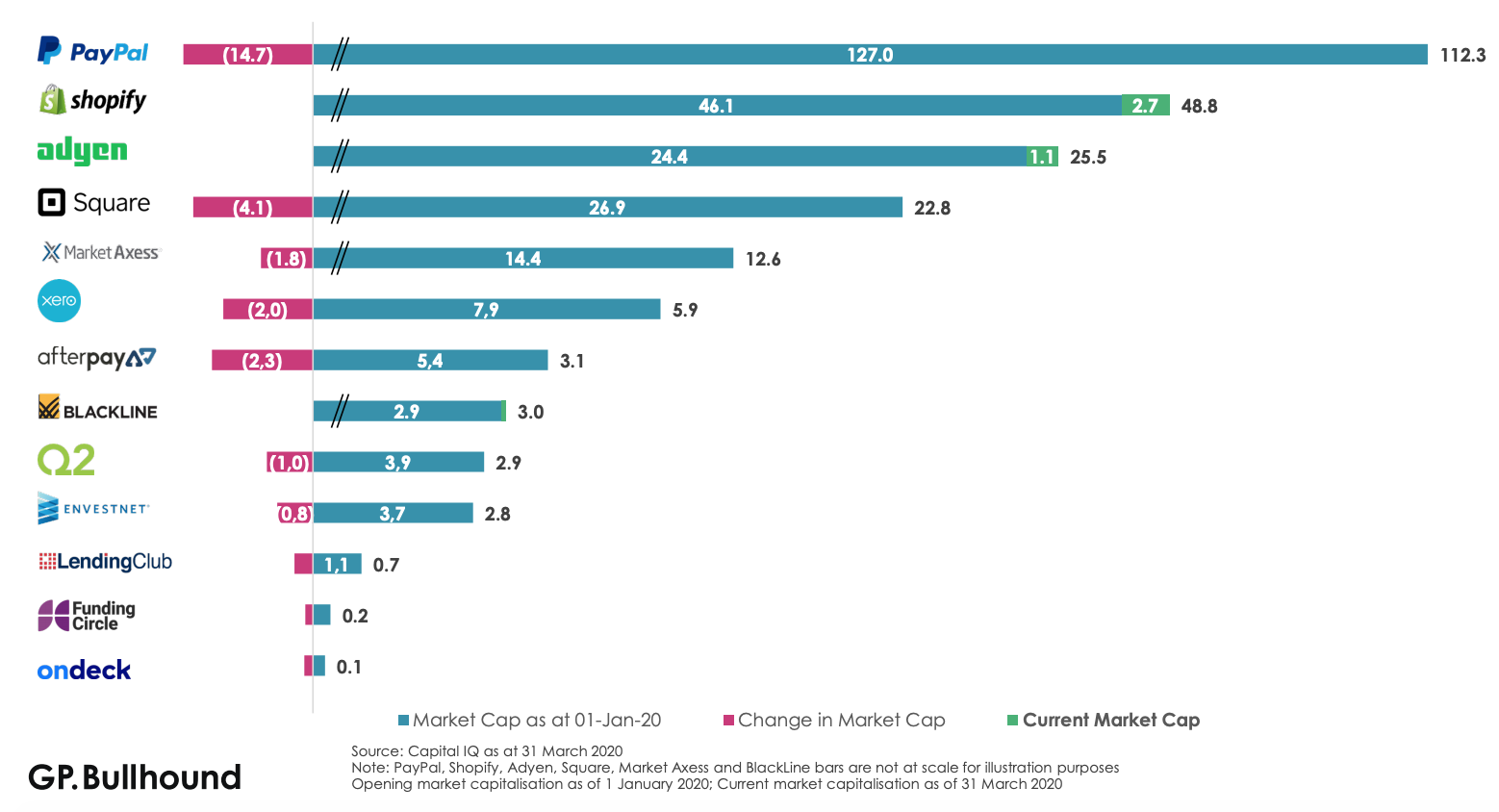

GP Bullhound’s fintech index, which includes 13 top public fintech companies such as PayPal, Square, Adyen, Lending Club and Funding Circle, dropped by ~US$24 billion throughout Q1 2020 as a result of the COVID-19 pandemic. The firm expects volatility to continue during the lockdown period.

GP Bullhound’s fintech index dropped by ~US$24bn over Q1 2020, Q1 2020 Sector Update Fintech, GP Bullhound, April 2020

Fintech transactions slowing down

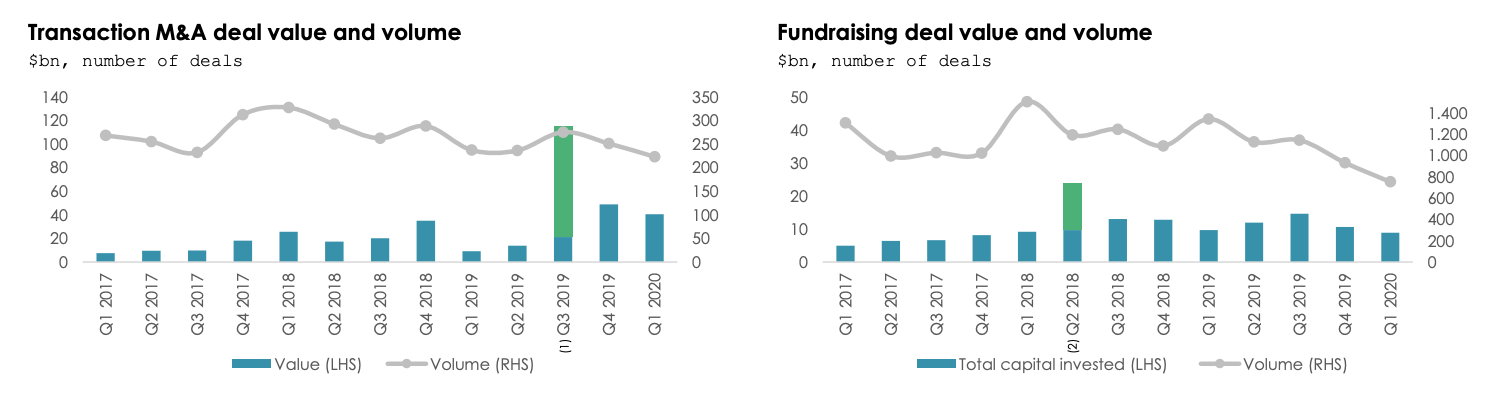

Fintech M&A and funding activity continued slowing down in Q1 2020, a trend that began in Q4 2019.

Fintech transactions, Q1 2020 Sector Update Fintech, GP Bullhound, April 2020

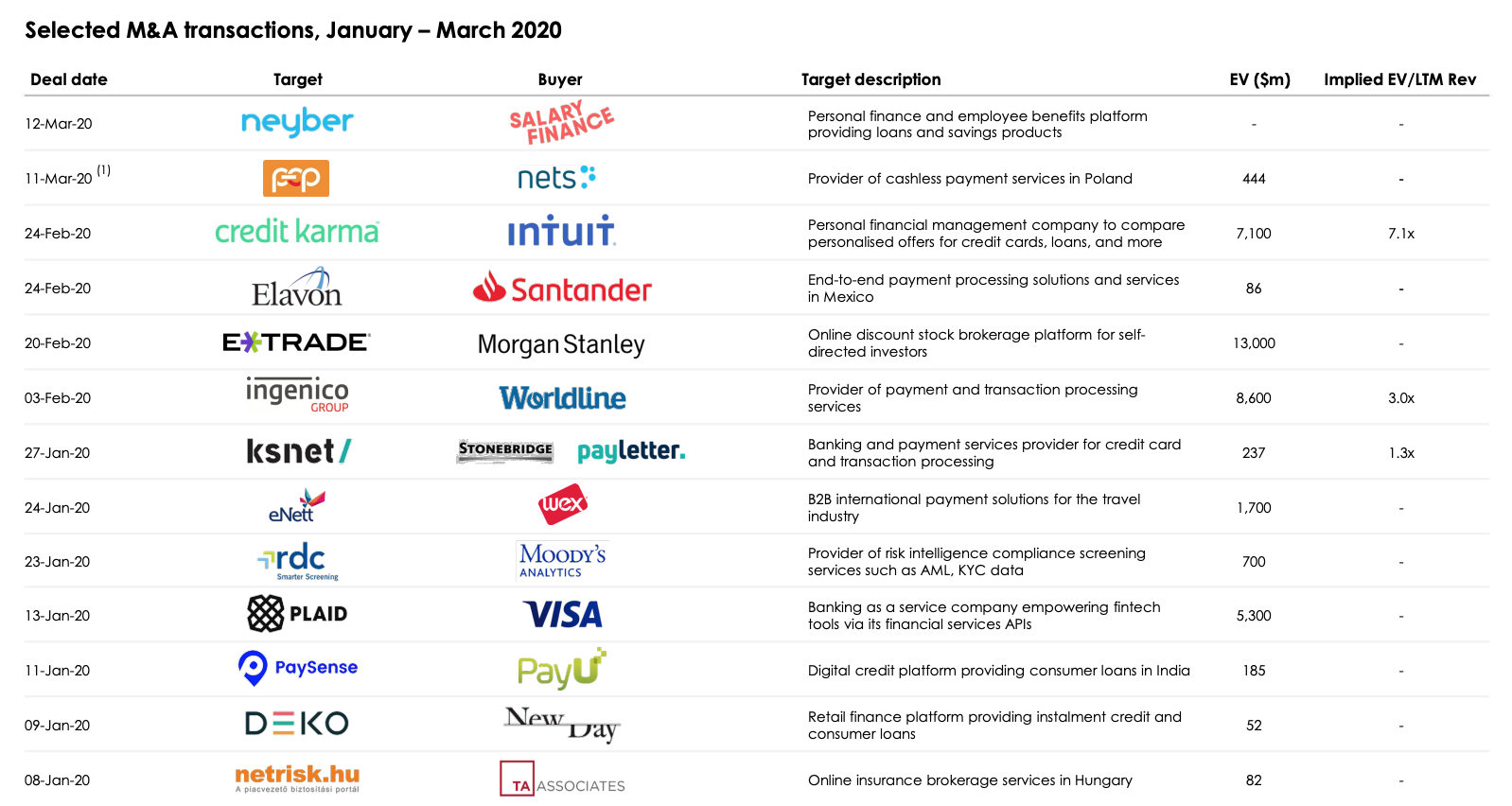

Further consolidation in the payments market took place with the two biggest deals being the acquisition of Plaid by Visa and the acquisition of Ingenico by Worldline.

The quarter also saw five challenger banks, including Tandem, Revolut, Starling Bank and Qonto, raise capital, showcasing that investors are still bullish and looking to gain exposure to startups in the space.

In these dire times, investors will increasingly focus on “quality of unit economics rather than growth at all cost,” the report says, and will favor those are able to demonstrate user growth through organic channels and highlight their capabilities monetizing users.

Fintech trends in Q1 2020

The study, which also examines private placements trends in Q1 2020, notes that in the past quarter, challenger banks renewed their focus in business banking with Monzo, Startling and Revolut all ramping up their free and paid plans to gain market share from traditional lenders in the past quarter.

In the AI/ML fintech space, software for KYC/AML processes, fraud detection, credit scoring and sentiment analysis, remained under the spotlight in Q1 2020 as the COVID-19 crisis provided players in the field with the chance to prove themselves.

Moving forward, the report says that leading companies such as AI-based ID verification platform Onfido, credit checking and credit product marketplace ClearScore, credit assessment services provider Aire, and client onboarding specialist Hooyu, could very well start winning significant market share from traditional players and come into 2021 as the new standard for AI/ML applications.

Q1 2020 also saw continued M&A activity in open banking with the acquisition of Plaid by Visa and more recently the acquisition of Strands by CRI. According to GP Bullhound, this is signaling the beginning of an M&A wave in this sector as incumbents look to enhance their capabilities in account aggregation, personal finance management and faster payments.