Facebook Readies Novi Launch; Digital Currency Wallet Could Support NFTs

by Fintechnews Switzerland August 31, 2021Facebook is preparing for the launch of Novi, a digital currency wallet that will be integrated into its multiple apps. David Marcus, the head of Facebook Financial (F2), the internal group developing the digital wallet, said Novi could be supporting non-fungible tokens (NFTs), an emerging type of digital tokens used to represent ownership of unique items.

In a memo on August 18, 2021, Marcus said that Novi was “ready to come to market,” adding that it has secured “licenses or [regulatory] approvals … in nearly every [US] state.”

The release could potentially happen before the introduction of Diem, the stablecoin and payment system the company has been working on through a consortium. Marcus told The Information however that he would prefer releasing Novi alongside Diem.

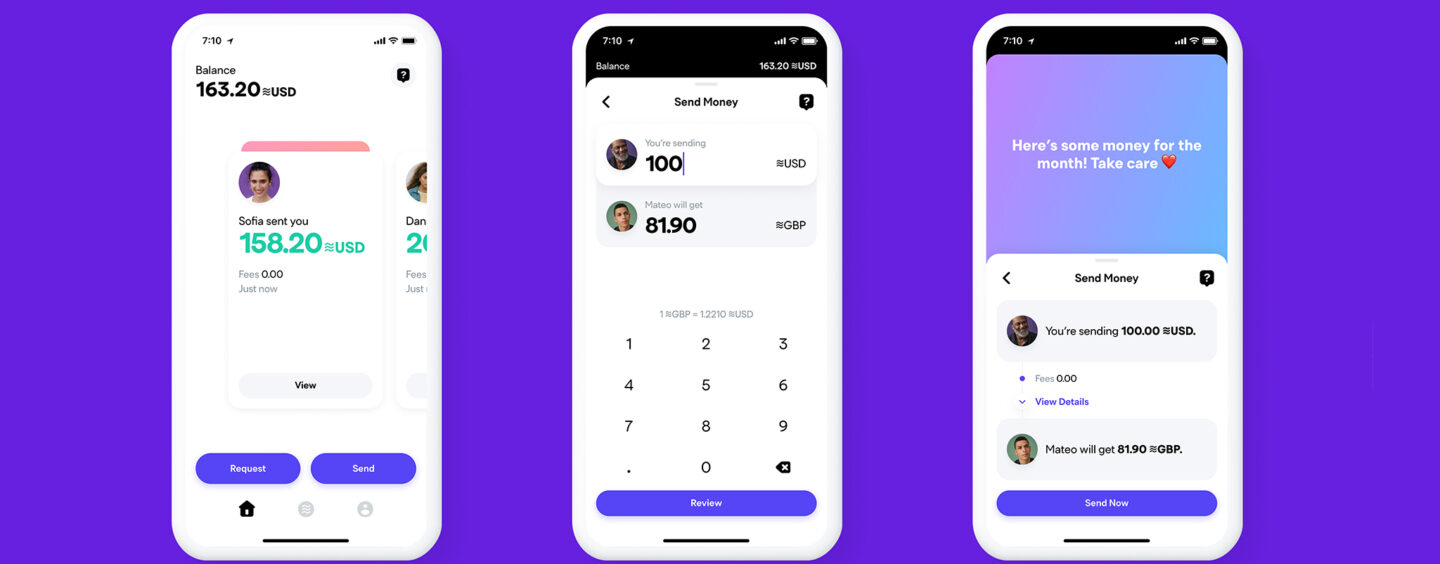

Designed for the Diem payment system, Novi, formerly known as Calibra, will offer free peer-to-peer (P2P) payments both domestically and internationally as well as “cheaper merchant payments to businesses,” he said, and could also incorporate products and features related to NFTs.

“We’re definitely looking at the number of ways to get involved in the space because we think we’re in a really good position to do so,” Marcus told Bloomberg Television. “When you have a good crypto wallet like Novi will be, you also have to think about how to help consumers support NFTs.”

NFTs, which are used to represent an array of things ranging from artwork and collectibles, to in-game assets, have been all the rage this year.

In Q1 2021 alone, sales of NFTs soared to over US$2 billion, more than 20 times the volume of Q4 2021, according to a report from NonFungible.com, a website that tracks NFT transactions and marketplaces.

Facebook first announced its stablecoin project, initially called Libra, back in 2019. The stablecoin originally sought to be backed by a basket of currencies including the US dollar, the euro, the Japanese yen, the British pound and the Singapore dollar, but later scaled down its vision to focus on launching a single coin backed one-for-one by the US dollar.

It rebranded to Diem at the end of 2020 after being met with severe backlash from regulators who worried it could threaten monetary stability, become a hotbed for money laundering, and infringe on users’ privacy,

Diem is backed by over 20 firms and non-profit organizations, which alongside Facebook, include publicly listed crypto exchange Coinbase, Singapore sovereign wealth fund Temasek, and venture capital (VC) firm Andreessen Horowitz.

Novi: what we know so far

Novie Homepage

Slated to launch by the end of 2021, Novi is designed for the Diem payment system, which comprises three core elements: a blockchain-based technological backbone of the payment system; Diem stablecoins backed by a reserve of assets made up of cash and short-term government securities; and governance by the Diem Association, the membership organization tasked with developing and operating the Diem payment system.

Initially, the system will support a few digital currencies including stablecoins pegged to the US dollar (≋USD), the British pound (≋GBP), and the euro (≋EUR), according to the Novi website. The Diem payment system will also support a combination of these digital currencies, ≋XDX. Over time, it intends to support additional digital currencies.

Users will be able to use Novi to purchase Diem tokens using their local currency, store them, use them to pay for everyday transactions, and send funds around the world, the website says.

Novi will be integrated into the Facebook, WhatsApp and Messenger apps but will also be available as a stand-alone app in the App Store and Google Play for users who don’t use these services.

As part of creating a new account, Novi will require full customer due diligence, including identification through the uploading of a government-issued identification, Marcus said.

Facebook’s fintech moves

Though Novi will focus on payment functionalities at the beginning, it will “branch out and offer a variety of other financial services in partnership with respected and well-regulated partners, and expand from there” once the digital currency wallet achieves a meaningful customer base, Marcus said in his memo.

Facebook has been an actor in the payment industry since at least 2009 when it started Facebook Payments. In the past four quarters, some US$100 billion worth of transactions have been enabled by Facebook, Marcus said.

This year, Facebook launched its payment capabilities on the WhatsApp platform in Brazil, introduced a loan program for small businesses in India, and began expanding its Facebook Pay feature beyond its own platforms, starting with Shopify.

Facebook’s payment business operates in over 160 countries, allowing individuals and businesses to make P2P payments, shop, make in-game purchases and donate in 55 different currencies.