Crypto in 2024 is set for a sensational year. By all appearances, the cryptocurrency bears have gone back into hibernation. With the Bitcoin halving rapidly approaching and spot Bitcoin ETFs on Wall St’s doorstep, the Bulls anticipate a glorious charge throughout the year ahead.

Older blockchains and coins in the crypto market are well understood by this time. We all know what BTC and Ethereum (ETH) are capable of and what we can expect from their roadmaps in 2024.

What about the newer, somewhat undiscovered digital currencies in the digital currency ecosystem? Which new protocols will find creative new ways of reimagining decentralized finance (DeFi), NFTs, and everything blockchain technology offers?

Table of Contents

Crypto in 2024: What to Expect

While 2023 saw Ethereum Layer 2s, zero-knowledge proofing, and Bitcoin Ordinals dominating the headlines, what big narratives can we expect to see in 2024?

Sponsored

Solana’s (SOL) meteoric growth towards the end of 2023, alongside the expansion of the Cosmos (ATOM) ecosystem through chains like Injective Protocol (INJ), suggests that the era of Ethereum-based dominance might be coming to an end.

Of course, despite the success of non-EVM (Ethereum Virtual Machine) chains, Ethereum-based smart contracts and dApps still rule the roost and attract the highest developer activity and TVL statistics. While non-EVM chains will thrive, platforms that find a way to leverage Ethereum-based architecture are automatically well-placed for user adoption.

Sponsored

Meanwhile, Bitcoin’s gravity cannot be ignored. With the next Bitcoin halving mere months away and a Spot BTC ETF expected to be approved early next year, things are looking good for the digital asset king. Bitcoin-Fi is coming, and Ordinals and BRC-20 tokens might have just been the beginning.

5 New Blockchain Projects and Protocols You Need to Know About

Quick disclaimer: the crypto market is largely driven by speculation and hype. As a result, shiny, new protocols tend to perform better than established platforms we’re already familiar with.

At the same time, this excitement and speculation makes these new crypto assets far more volatile and high-risk. They may not be well-suited to low-risk investment strategies.

Let’s explore some of the most captivating and new blockchain projects we can expect to see more of in 2024.

1. Monad

Monad is an emerging Layer 1 blockchain that promises to do what every other Layer 1 blockchain promises. Like many before, the Proof-of-Stake network claims greater scalability, security, and decentralization than its Web3 rivals. Nothing we haven’t heard before, right?

Where Monad separates itself from its peers is in its network architecture. Like Aptos (APT), Monad leverages pipelining and a Parallel Execution Engine to reach a transaction throughput of up to 10,000 TPS (transactions per second). On top of that, Monad boasts a 1-second blocktime and single slot finality, ensuring the blockchain can handle huge amounts of traffic.

The final jewel in the crown, Monad is also fully EVM-compatible, making it easy for developers and users to port across and interact with the Monad network as easily as they would on any Ethereum-based network.

The Monad blockchain has yet to launch; however, the network’s Testnet is expected to go live in Q1 2024. With backing from Dragonfly Capital and other influential firms, Monad is not to be missed in 2024.

2. Celestia

A recent addition to the thriving Cosmos ecosystem, Celestia tackles blockchain architecture from a new angle. While monolithic blockchains like Ethereum have frequently suffered from scalability issues, modular networks like Celestia work by decoupling blockchain consensus and transaction execution.

In simple terms, modular networks split blockchain functions to promote smooth and diversified operations. Using Celestia, developers can easily launch their own blockchain using a variety of existing virtual machines, including EVM or Cosmos-based platforms.

What’s more, becoming a network contributor is easier than ever. Many blockchain enthusiasts successfully operate Celestia light nodes from their mobile phones, helping to decentralize and secure the network from their pockets.

The Celestia blockchain, along with its native token, TIA, was launched in the final quarter of 2023. While it’s technically not a ‘new’ chain launching in 2024, this emerging network is still largely unknown by many crypto enthusiasts, earning it a place in this list.

3. LayerZero

Interoperability has been one of the biggest hassles facing cryptocurrency for years. Bridging digital assets across chains can sometimes be a complicated nightmare, plagued with high fees, slippage costs, and plenty of exploits and hacks.

Layerzero aims to solve this monumental task by providing the necessary infrastructure that will allow different blockchains to communicate effectively. We’re already seeing the high demand for LayerZero services and products, with cross-chain bridges like Stargate making it easier than ever to move stablecoins and other sources of liquidity across 50+ networks in a few quicks.

Having already transferred over $50B worth of crypto assets across dozens of chains, LayerZero is just getting started. With a generous airdrop expected to occur sometime in 2024, it’s worth adding LayerZero to your list of coins to watch in crypto in 2024.

4. Inscriptions

Ordinals and BRC-20 tokens have taken the crypto market by storm in 2023, bringing exciting new use cases to Bitcoin and completely reinventing the fundamentals of the world’s largest cryptocurrency. Certain BRC-20 protocols and providers, like TRAC and PIPE, promise to bring Bitcoin into the future by building native DeFi applications on the Bitcoin network.

But the excitement hasn’t been limited to Bitcoin alone. Inscription tokens have been cropping up on almost every blockchain in the industry, driving transaction fees haywire across the space. Whether SOLS on Solana, DOGI on Dogecoin, or POLS on Polygon, inscription tokens draw plenty of ire from all sides.

One could argue that while BRC-20 tokens might have a unique role in Bitcoin, they’re largely redundant on blockchains that are already programmable. We still haven’t heard the end of Bitcoin Ordinals and BRC-20 tokens.

5. NEON

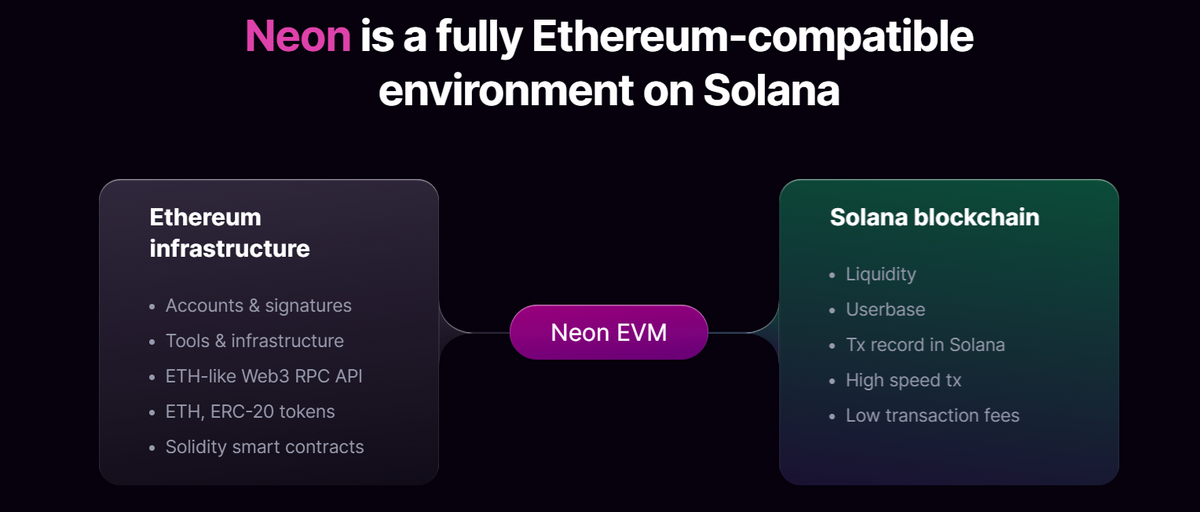

Last but not least, NEON joins our list of exciting new blockchain protocols to watch in 2024. NEON EVM is a unique network that aims to give us the best of both worlds and dispel Layer 1 maximalism forever.

NEON EVM is an Ethereum-compatible blockchain built on Solana. This means that users and developers can enjoy the benefits of Ethereum-based smart contracts while settling transactions using Solana’s industry-leading speeds and minimal gas fees.

Like TIA, the NEON blockchain and native token went live towards the end of 2023. Following the price of Bitcoin, both assets witnessed a surging market cap and posted new all-time highs in December 2023.

As a part of the wider ecosystem, NEON is widely expected to follow Solana’s price movements. However, given its smaller market cap and lower liquidity and trading volume, the asset will suffer much higher volatility.

NEON takes the best fundamentals of Ethereum and Solana and mixes them into one complete package. If you are a fan of Solana, Ethereum, or even both, NEON is a crypto worth researching in 2024.

Crypto in 2024 Pros and Cons

Naturally, there is still plenty that could go wrong in crypto in 2024. After the Terra Luna collapse devastation and the FTX insolvency, 2023 seemed to be the ultimate rally year. Before getting too euphoric heading into 2024, let’s look at the pros and cons that could await us.

Pros

- Spot Bitcoin ETF – A Spot Bitcoin ETF approval would allow some of the world’s largest financial institutions, like BlackRock, to start offering BTC funds to their clients. This could potentially bring an influx of billions into the crypto market.

- Improving Technology – Blockchain technology continues to evolve, bringing a wealth of new use cases we couldn’t have imagined a few years ago.

- Real-World Adoption – Blockchains are slowly becoming better equipped to handle large amounts of users. This means that these decentralized networks are finally becoming ready for mass adoption.

Cons

- Crypto Exchange Woes – Despite growing popularity, crypto exchanges remain in hot water. Coinbase, Binance, and Kraken all have lingering legal disputes with everyone from the SEC to the Fed, making it hard to onboard new users.

- Institutional Resistance – Just because BlackRock and Valkyrie are on board doesn’t mean every Wall St brokerage wants to see crypto succeed. JPMorgan CEO Jamie Dimon has made his anti-bitcoin thoughts very clear, recommending that the Government should shut it down.

- Misuse of Technology – While Blockchain has many benefits, some would argue that its functions can be misused. For example, Central Bank Digital Currencies can give governments far greater control of your money than is currently possible.

On the Flipside

- It’s important to note that a Bitcoin halving doesn’t automatically guarantee a new crypto bull run. There are no certainties in the crypto market, so evaluate your risk tolerance before investing.

Why This Matters

Staying informed on fascinating new projects in the crypto space is a good way to keep ahead of the curve and learn about emerging protocols before they become popular.

FAQs

As mentioned, there are no guarantees in the crypto space. While plenty of positive events are forecast for 2024, nothing is certain and the market may not react as expected.

The best way to know which crypto will be best in 2024 is to conduct your own thorough research and develop conviction in your own thesis. Avoid investing in coins you don’t know or understand.

Like all cryptocurrencies, Ethereum is prone to volatile price fluctuations, making its price difficult to predict.