Switzerland and Singapore deepen partnership to chart fintech’s future

Economic ties remain strong, with significant jumps in Swiss foreign direct investment into Singapore

WHEN regular trade between Singapore and Switzerland kicked off in the 1830s, it was not clocks and watches but Swiss-made sarongs – brightly-coloured woven and printed textiles – that were the main goods making the long journey over land and sea to Singapore’s free port.

Fast-forward about two centuries, and Swiss-Singapore economic relations have evolved and expanded dramatically. Yet the emergence of fresh areas of cooperation today – in fintech, sustainable finance, digital economy, food and agri-tech and more – remains anchored on both economies’ strong alignment in valuing free trade, says the Swiss ambassador to Singapore, Frank Grutter.

Swiss direct investment into Singapore has risen significantly over the last five years of available data. Foreign direct investment (FDI) from Switzerland more than doubled from S$38 billion in 2017 to S$88 billion in 2021.

This was a jump from 2020’s S$69 billion, making Switzerland Singapore’s single largest source of FDI from continental Europe, and its ninth-largest investor globally.

“We saw a strong economic relationship between the two countries before Covid, and we see even stronger economic ties now after Covid,” ambassador Grutter tells The Business Times (BT) in an interview.

He notes that both countries managed the pandemic well – though the governments adopted different approaches – and both have seen their economies rebound accordingly.

A NEWSLETTER FOR YOU

Asean Business

Business insights centering on South-east Asia's fast-growing economies.

Like investment, trade has been on the rise too.

In 2022, Switzerland exported 9.9 billion Swiss francs (S$15.2 billion) in total goods to Singapore, which was the fourth-largest destination for Swiss goods in Asia and 12th-largest worldwide.

Traditionally dominant chemical and pharmaceutical exports led the growth in exports, though their overall value did slip 6.7 per cent to 2.86 billion Swiss francs in 2022.

Precision instruments, clocks, watches and jewellery exports – which made up the remaining bulk of Swiss exports to Singapore – totalled 2.37 billion Swiss francs in 2022, despite disruption from the Covid-19 pandemic.

Swiss exports of transport, financial, telecommunications, computer and information services to Singapore drove an increase in services exports to S$13.2 billion in 2021, making Switzerland the eighth-largest source of services flowing into Singapore in 2021.

“We’re both free market advocates and believe in the benefits of free trade, so we are very much in agreement on these issues in international fora,” says Grutter.

Both countries have also worked well on multilateral platforms on topics such as cybersecurity and digital governance.

Grutter sees that alignment as arising from inherent similarities between the two nations. “I would start with the fact that we’re both small in size; we’re not countries that can rely on big power politics.”

“Neither of us has an economic hinterland. We have to look beyond our borders in the sense that the world is our market,” he says.

“As a result, both countries have similar views on free trade, the importance of secure supply chains and the free movement of capital, et cetera.”

Fintech and digital economy

Switzerland and Singapore are also both major financial centres, with a shared reputation for being competitive global wealth management centres (coming in first and second respectively on Deloitte’s International Wealth Management Centre Ranking 2021).

As the fintech ecosystems in both countries boomed in recent years, fintech has emerged as a key area of collaboration too.

The Point Zero Forum – a not-for-profit three-day gathering in Zurich to promote policy and technology dialogue about financial services – is one outcome of Swiss-Singapore finance cooperation at the government level.

“What is really positive about the Point Zero Forum is that it brings together high-level people – from financial regulatory authorities on both sides, national banks, fintech founders and investors, to traditional banking institutions, but also think tanks and civil society,” says the ambassador.

Co-organised by Switzerland’s State Secretariat for International Finance and Elevandi, a not-for-profit entity set up by the Monetary Authority of Singapore, the second edition of the forum in June 2023 drew a thousand such leaders in the fintech world.

Their dialogues this year centred on digital assets, the potential and risks of generative artificial intelligence in financial services, and harnessing fintech to catalyse the green transition and sustainability.

The launch of the Point Zero Forum seems a natural extension of the significant Swiss presence under the Swiss Pavilion at each edition of its sister event, the Singapore Fintech Festival. Last year, about 20 Swiss fintech enterprises took part – many with the goal of introducing their emerging technologies and solutions to Asia.

Several participants of past editions of the festival have since set up offices in Singapore as a launch pad for expansion plans in South-east Asia and the wider region.

“What we see from the Swiss side is a strong interest in coming to Singapore and in using Singapore as a base for the wider region,” says ambassador Grutter.

“There are some new companies coming, and some of those who are already here are bringing new people here as well.”

Examples of Swiss players that are now part of Singapore’s fintech ecosystem range from regtech Apiax, to digital asset bank Sygnum Bank, to early-stage investor Tenity, which incubates and accelerates fintech and insurtech startups in Asia out of its Singapore hub.

Meanwhile, wider efforts to improve business conditions for Swiss companies with Singapore links continue apace as part of the embassy’s economic promotion efforts.

These include further lowering barriers to trade – even digital trade. In February, Switzerland and the three other EFTA states opened negotiations on a digital trade agreement, to bring the 2003 EFTA – Singapore Free Trade Agreement into the digital domain.

“It will provide greater legal certainty for businesses and consumers that are involved in digital trade,” says Grutter.

“For example, consumers will know what their consumer protections are and businesses will know what Singapore’s and Switzerland’s data privacy rules are. It’s meant to be practical, so that e-commerce, e-payments, e-invoicing, and e-services can be facilitated between Switzerland, the EFTA countries, and Singapore.”

People flows

Last year, tourism from South-east Asia to Switzerland posted a strong rebound after pandemic-related travel restrictions eased.

The more than 623,000 overnight stays in Switzerland from South-east Asian tourists marked 96 per cent of the pre-pandemic 2019 figure, achieving a nearly complete recovery.

Visitors from Singapore accounted for more than a third of these overnight stays. For the first four months of this year, Singapore generated over 65,000 overnight stays – a 54 per cent jump from the same period in 2019.

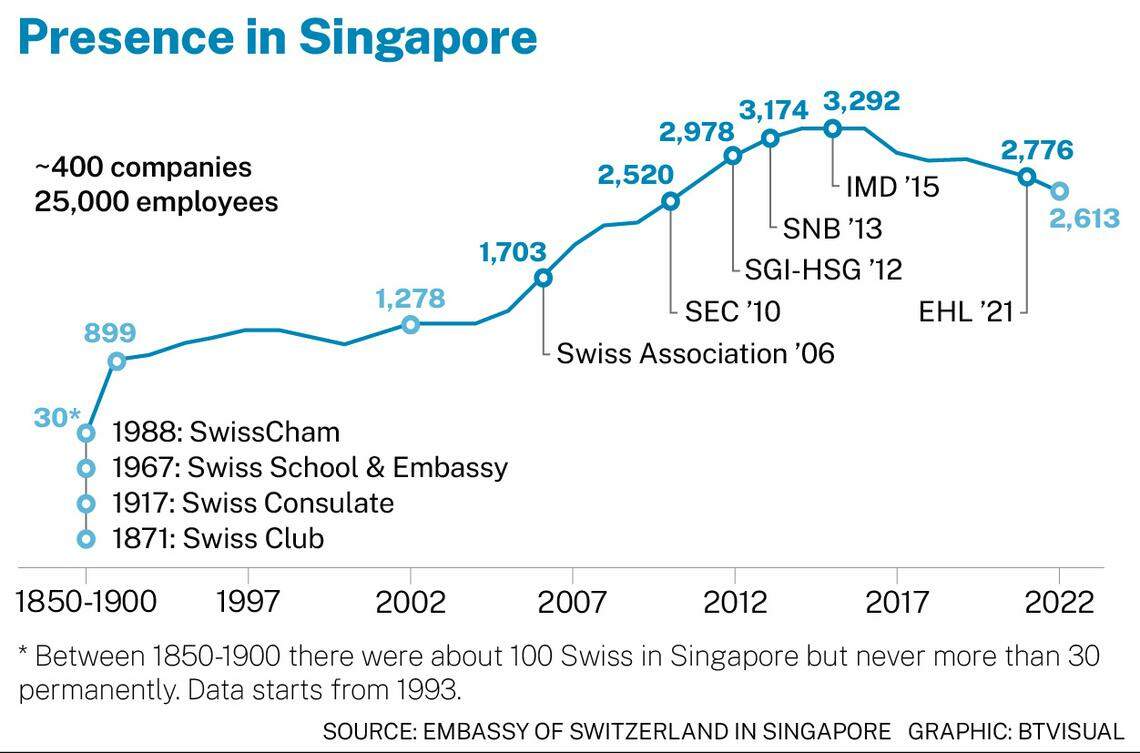

Currently, an estimated 400 Swiss companies have a presence in Singapore, employing more than 25,000 employees.

While this has held stable, the number of people registered with the embassy has been declining, says Grutter.

In 2020, there were 2,855 Swiss in Singapore registered with the embassy – 3.2 per cent down from the year before. This slipped a further 2.8 per cent to 2,776 in 2021, and another 5.9 per cent in 2022 to 2,613.

There was probably some impact from the pandemic, as some families returned home.

But rising rental costs likely contributed to both personal decisions to leave Singapore, as well as corporate decisions to send individuals rather than families on postings to Singapore, notes Grutter.

It is a challenge that is not unique to the Swiss community here, he adds. Eurocham Singapore’s March 2023 survey report on the rising cost of rental in Singapore found that soaring residential rental rates, in particular, were a main driver for the rise in respondents’ business operational costs.

Close to 40 per cent of companies surveyed were providing each expatriate employee with additional financial aid of more than S$1,500 a month to subsidise those rising residential rental costs.

And 69 per cent of respondents indicated that they would have to relocate personnel out of Singapore if operating costs continue to climb.

But given the long and rich history of the Swiss community in Singapore – the Swiss Club, for instance, was founded here in 1871 – it continues to stand firm.

“Compared to other Swiss embassies in the region, there are none with such a density of Swiss players as ours,” Grutter observes. “With the Swiss School, the Swiss Chamber of Commerce, the Swiss Association, four Swiss higher-education institutions and an office of the Swiss National Bank, the Swiss community in Singapore is strong.”

Swiss watchmakers – who swiftly followed Swiss textile manufacturers in exporting to Singapore in the 1830s but took several decades to establish their trade – have since had a solid presence here.

To this day, Singapore is the fifth-largest market for the Swiss luxury watches industry – valued at 111.5 million Swiss francs in 2023.

These linkages reach beyond the dollar value. At local luxury watch retailer Cortina Watch’s 50th anniversary celebrations last year, Grutter was amazed at how many high-level representatives of Swiss watch companies were in attendance.

He says: “This shows how strong these relationships are, and how close the personal ties are between the Singaporean and Swiss business communities.”

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

International

Indian vote body tells X to remove Modi party video targeting Muslims, opposition

Inflation-hit Argentina has a new top banknote, worth just US$10

Trade between Singapore and Asean was at S$295.6 billion in 2023

One out of every 24 New York City residents is a millionaire

Private credit faces pain from high interest rates, Moody’s says

BOE postpones Long-Term Repo Operation due to tech issues