Contemporary technological developments in the finance market have transformed the traditional monetary set-up to enable a better and smoother user experience with a seamless shift to an entirely new digital proposition. Paying for your food straight in a delivery app or getting insurance through a car rental app (where your phone serves as the key to the vehicle) is not just a viable possibility but a reality now. The technology that allows any company from any industry to integrate and sell financial services is known as embedded finance.

The prevalence of embedded finance is expected to expand significantly as it helps to integrate financial services into websites and mobile applications helping businesses acquire full control over the customer experience and explore new revenue opportunities. Integration of embedded finance in existing business models is paving the way for accelerated business growth.

Embedded finance uses connective technologies to enable merchants or brands to offer lucrative financial services to customers at a relatively lower cost. The widespread usage of open application programming interfaces (APIs) and cloud computing has accelerated the process of making embedded finance practical and accessible by lowering entry barriers.

“Embedded finance is all about bringing two large industries—financial services and digital applications—together to make the world work better. While delivering digital applications is permissionless, financial services is a highly regulated space, which makes this combination, despite its value-creation potential, very hard in practice. This barrier is now being removed.” – Alex Mifsud, Co-founder and CEO, Weavr.io

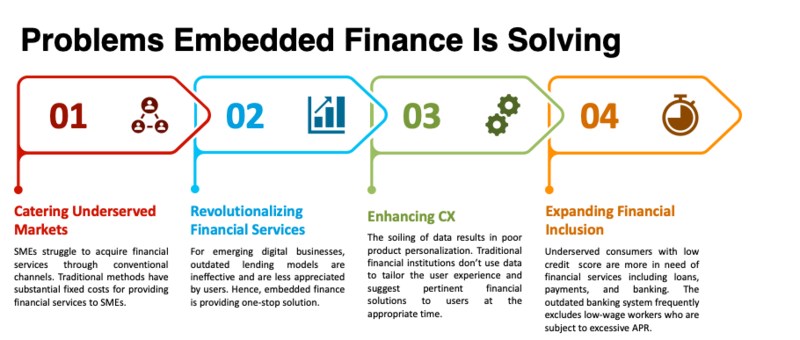

The embedded finance market is anticipated to reach $7.2 trillion by 2030, growing at a CAGR of 23.9% over the years 2022–2030. Embedded Finance is expected to make inroads in sectors like healthcare, real estate, education, and telecom given high untapped potential, even though some of the early embedded finance models (such as payments and loans) are beginning to mature.

Ways Embedded Finance Interacts with Consumers

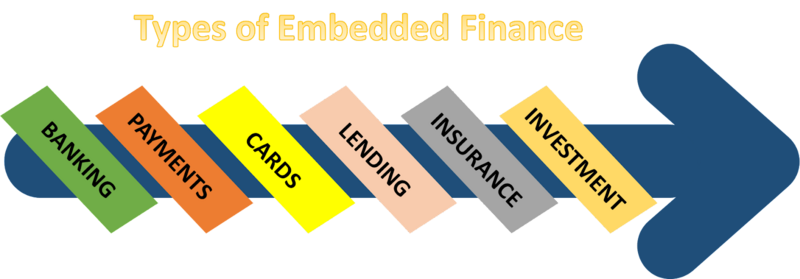

Embedded finance is typically categorized in six different areas.

-

Embedded Banking

It is the practice of integrating conventional banking instruments—such as debit cards and checking accounts—into non-financial areas, such as an online marketplace or retail outlet. Once integrated, it can generate enormous value for company's clients. These services are available from banking as a service (BaaS) providers to non-financial businesses.

Due to the advent of BaaS technology, organisations across numerous industries look to take advantage of these characteristics to expand their business horizons. Global corporations like Starbucks, Walgreens, Walmart, etc. have introduced embedded services to increase sales and boost client retention.

-

Embedded Payments

Embedded payments enable consumers to pay directly from their bank accounts through third-party on non-finance applications. Such type of payment does not require any type of card or other details, making the process simpler and quicker. These are transactions that a user can make using a bank's internal money movement mechanisms that have been made accessible to upstream apps (like a mobile app or bank website).

Revenues for the embedded payments sector are predicted to increase from $43 bn in 2021 to $138 bn in 2026. Banks can integrate third-party payment plug-ins to reinvent the user experience where the payment simply occurs as a component of consumer interaction.

-

Embedded Cards

An integrated circuit card, sometimes known as a chip card, is a payment card that stores data in addition to (or instead of) a typical magnetic stripe using an embedded microchip, is known as an embedded card. Embedded systems have an integrated circuit to perform real-time operations. Embedded cards are integrated into a broader offering mainly an e-wallet working mostly in the B2B domain. For example, issuing credit with payment cards enables customers for a smooth access to funds instantly. It even supports customers retention or loyalty.

Another use case is expense management; A payment card also allows you to collect additional information about how, when, and where your consumers spend their money. For example, transactions are automatically categorised to do this.

-

Embedded Lending

The main goal of embedded credit/lending is to significantly boost access to credit by allowing non-financial businesses to connect, embed, or integrate lending capabilities that are typically handled by banks or non-bank financial companies (NBFCs). It enables customers to obtain loans from a point of sale (POS) either through the merchant or an integrated third party. For instance, Shopify introduced Shopify Capital, which disburses loans without the need for separate applications to support SMBs. Similarly, clear.co is a service that issues needed capital without taking a piece of equity. It is a streamlined, effective method for meeting urgent liquidity needs, an alternative to a bank loan or venture capital funds.

-

Embedded Insurance

The real-time bundling and sale of insurance while consumers are purchasing a product or service through POS or online channels is known as embedded insurance. To put it simply, embedded insurance is any insurance that may be acquired as part of a business transaction. For instance, Apple offers customers to buy device insurance while purchasing apple products.

-

Embedded Investment

Embedded investment helps businesses to offer funds and stocks to their customers for easy investment. Also, it allows businesses to incorporate stock market investment capability to their product offering. By providing APIs to manage end-to-end flows, including account opening, financing, trading, management, and market data, brokerage companies that operate on APIs are bucking the trend. For example; Paypal enables customers to purchase cryptocurrency from their PayPal accounts.

“The proliferation of software services are specifically designed to take the pain out of undifferentiated operations means businesses can focus on what makes them special. This is best encapsulated in the rise of vertical-specific software platforms.” – Edward Moore, Head of EMEA SaaS Platforms, Stripe

The potential for financial services to penetrate non-financial sectors is unprecedented—and it is just the beginning. As more businesses use integrated finance and customers gets accustomed to these services, this financial transformation will spread exponentially throughout almost all industries.

As per survey estimates released by Yobota, approximately 60% of banks and financial services firms introduced one or more digital products in 2021; further, it revealed that ~ 44% of businesses intend to spend money on embedded finance and lending solutions towards the end of 2022. By integrating financial services and products into non-financial organisations, embedded finance enables businesses to independently offer financial solutions related to their products and services.

With traditional banks being so well-established and resourced, as well as, regulatory barriers that new entrants to the market find challenging to overcome, the finance industry has historically been tough to penetrate.

How Open API Is Changing The Game

Fintechs and non-financial brands have been able to enter the market in this set of new rules and technology, particularly those surrounding APIs, by unbundling banking product portfolios and providing better convenience by concentrating their efforts on the provision of financial services with the consumer firmly at their centre. When it comes to managing their finances, both consumer and corporate clients value convenience and on-demand availability.

They prefer to do so digitally and to have their payment information maintained on non-banking applications, such as those used by e-retailers and other third parties. For instance, an increasing number of non-financial companies are gaining market share and utilising API technology to increase the range of financial services they offer.

APIs aren’t just technical interfaces; rather, they are seen as vital products with a variety of uses, including enhancing customer pleasure, generating new revenue sources, and enabling the diversification of service offerings. The user experience is optimised via APIs, which also showcase the identities of banks and fintech.

The expansion of embedded finance is mostly driven by the rising availability of Open-APIs from financial industry companies. For providers of embedded finance, the simple integration of these Open-APIs will unlock a substantial new revenue opportunity.

An API interface is a simple system that enables two or more software programmes to interact and communicate with one another without experiencing communication issues. When building applications, it is simpler to integrate the open API with pertinent services and open-source data. The open API's ability to offer granular access to data and system functions in a safe, managed, and reasonably priced manner is the main factor influencing demand in many industries.

How Much Money Is More Money?

Embedded finance has gained the attention of venture capitalists (VCs) and has raised bn of dollars in capital over 2020-21. VCs have doubled their investment in embedded finance companies operating in the US and Europe regions to $6.7 bn in 2021, with the US emerging as the biggest recipient of investor money. Pre-seed and seed round amounts have become stagnant, although the market is maturing as a result of a growing percentage of larger rounds.

|

Company |

Year |

Headquarters |

Amount ($ mn) |

Exit Route |

|

Marqeta |

Q2 2021 |

US |

1,200 |

IPO |

|

Blend |

Q2 2021 |

US |

360 |

|

|

Affirm |

Q1 2021 |

US |

1,200 |

|

|

Greensky |

Q3 2022 |

US |

Acquired by Goldman Sachs |

Acquisition |

|

Twisto |

Q2 2021 |

Czech Republic |

Acquired by Zip |

|

|

Even Financial |

Q4 2021 |

US |

Acquired by MoneyLion |

Multiple VCs have exited their investment from embedded finance companies via public listing or buyout routes. The majority of such deals were observed in the US market in 2021, whereas, many European companies pushed their plan to go public in 2022 amid the public market slowdown, rising inflation, and global instability due to the Ukraine/Russia conflict.

Regulations - A Watchkeeper of The Industry?

Businesses are looking forward to working within the changing financial regulatory prospect as it has unlocked a repository where merchants and companies are allowed to offer their clients/customers more financing options outside their offering. Customers will continue to benefit from more accessible, frictionless, and contextual financial services.

Embedded finance is also expanding to various financial sub-sectors, like lending, payments, cards and insurance given the breadth of embedded finance is growing. The value chain is both fragmented and consolidated as a result of the increase in the number of new enablers catering to certain niches making it imperative for regulatory bodies to safeguard consumer interests by creating stringent data and encouraging policies.

Data privacy regulations and steps to reduce the risk of fraud will be key components in the success and acceptance of applications of embedded finance. As the number of digital transactions is increasing everyday customers should be assured that their financial information is secure and protected. Given that APIs can transport massive amounts of complicated data, new services and customer acquisition strategies must be balanced with an emphasis on the user experience, giving the consumer choice over their data usage. Customers feel more secure knowing their personal information is protected to the same extent as at banks when providers adhere to appropriate risk mitigation methods and certifications, such as ISO 27001. It has become imperative that embedded finance providers form alliances with reputable, governed embedded finance hosts.

As embedded finance evolves, it is likely to contribute towards the expansion of regulations such as the Bank Secrecy Act’s anti-money laundering provisions (BSA). Also, machine learning and various AI-based solutions can help in the prevention and detection of cyber fraud.

Financial service providers are encouraged to minimize friction in the customer experience and effectively utilize embedded technology to maintain their competitive edge. The widespread usage of open APIs and cloud computing has accelerated the process of making embedded finance feasible and accessible by eliminating entry barriers. The next wave of digital transformation is here - gear up for the change.