What are examples of embedded payments? - It is a common feature of payroll automation software and many food delivery applications such as Grubhub, Gopuff and Swiggy which enable users to make purchases and payments without switching between apps.

It may be referred to as a CX strategy or an e-commerce operation as it emphasizes the transition in e-commerce towards streamlined, simpler shopping experiences.

Embedded payment’s significance is largely correlated with customer preference for convenience. Given that advanced payment infrastructure predominates in the majority of industries, a business must provide cutting-edge payment solutions for a seamless digital experience that allows them to complete a transaction without causing any checkout trouble. Incorporation of financial services gives every business additional chances to add value by giving clients valuable digital experiences including practical payment options, and by providing specialised finance solutions.

Embedded payments may become common enough to make that experience the norm, for which Amazon - the biggest retailer has already planted the seeds. Amazon pioneered embedded payments with its "Buy Now" rapid buying option. Customers' shipping addresses as well as credit card or bank account information are stored by Amazon. Customers need to confirm the payment method and shipping address when clicking "Buy Now" on an Amazon product page. The worldwide retailer utilizes these automatically. It only takes a few seconds to complete the transaction. Following Amazon's example, Uber, GrubHub, and other businesses have combined "put order" and "pay" into a single embedded payments feature.

How Banks Are Participating in the Bandwagon of Embedded Payments?

Traditional incumbents are also looking for a promising way to provide their customers with convenience and accessibility to advanced technology. The technology has, however, historically been out of reach, even among the top financial institutions. According to the IDC analysis, 73% of financial institutions worldwide lack the necessary technology infrastructure to handle payments in 2021 and beyond.

There is a demand and opportunity for banking services to be better connected with core business software, as seen by the rising amount of information requests from companies in the expenditure and procurement sectors. Banks frequently lack the access or resources necessary to maintain these linkages. Some people are turning to fintech partners who act as an intermediary to combine several services. In this approach, financial services can be easily accessed by software businesses, and banks can start modernizing their suite of offerings.

This is an opportunity for banks to create an ecosystem that encourages cooperation. They do not require to partner with every fintech. ;Banks don't even have to develop and sell every new solution or user experience since flexible APIs allow customers and third parties to access as many services as feasible. Furthermore, anyone looking forward to building a custom payment solution can partner with the bank. Exposing APIs may raise compliance red flags, but this is where those strategic fintech alliances may help. Find a partner who can reduce your onboarding efforts and related risk concerns and act as an aggregator or gateway to your services.

How Big Is the Embedded Payments Opportunity and the Importance It Holds

Major advancements in technology have been made in the financial services industry, particularly in payments. The "period of fintech" has come about as a result of a significant increase in innovation rate over the previous five years.

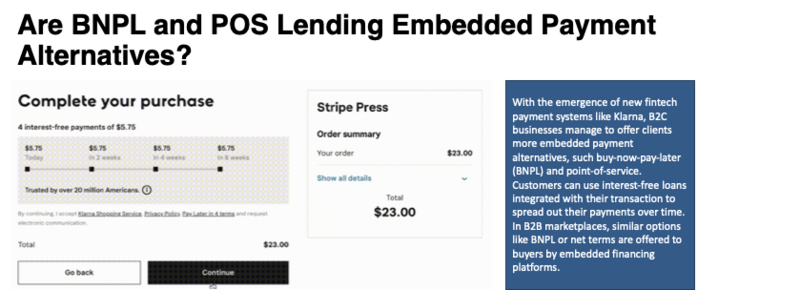

Revenues for the embedded payments sector are predicted to increase from $43 billion in 2021 to $138 billion in 2026, indicating a significant expansion of the sector. We are witnessing a wider range of embedded payment technologies becoming accessible to organizations of all sizes as financial institutions reevaluate legacy systems and concentrate on digital transformation. This opens the door for banks to provide new digital products to the small- and mid-market as well as the enterprise.

Embedded payments are a crucial client retention strategy at a time when businesses are scrambling to recover from the pandemic's significant revenue and customer loyalty losses. Within the first nine months of the economic shutdowns in 2021, customer brand loyalty in the U.S. decreased by sixteen percentage points to 49%, according to Omnicom Media Group.

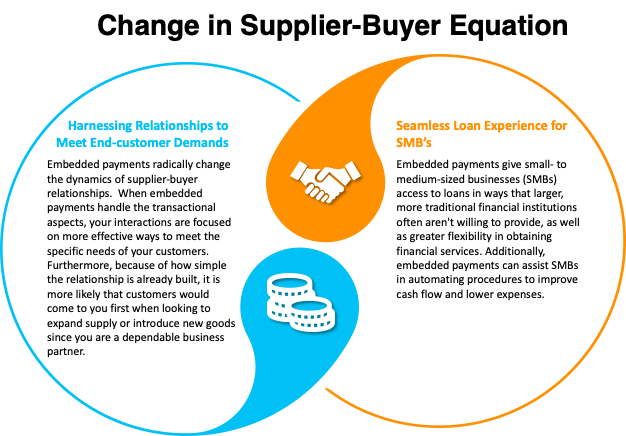

Businesses in B2B marketplaces are attempting to prevent a similar decline in client loyalty by adapting to advance payment technology for shifting customer needs and preferences. They can improve customer loyalty and raise purchase volume and frequency with embedded payments.

Embedded Payments to E-Commerce Success

As more businesses integrate embedded payment solutions on their platform, the expectations of consumers for convenient transactions and satisfying procedures have escalated. The simplicity, ease, and convenience of embedded payment models are infinitely superior to conventional digital checkouts, which require customers to submit a substantial amount of information and undergo multiple procedures to complete a transaction.

The simplicity, ease, and convenience of embedded payment models are infinitely superior to conventional digital checkouts, which require customers to submit a substantial amount of information and undergo multiple procedures to complete a transaction.

Additionally, the demands of B2B buyers have also expanded. When you integrate embedded payments using an equipped platform you can streamline the payment process and provide extended terms directly at the point of sale. Consumers can immediately pre-qualify for credit and sign up.

The Takeaway

Embedded payment is propelling non-financial platforms or businesses to alter their code of conduct to maintain market dominance. It provides a tonne of accessibility and convenience that, in a world where transactions are increasingly going digital, is too hard to ignore. Consumers or end-users are the primary benefactors of integrated finance since it provides them with a plethora of affordable, customized, and easy-to-access financial services.