With the settlement of dust from the upheavals in the payments industry, a new picture is revealed marking the establishment of a better together landscape where businesses are powered by integrated payment structures making software idiosyncratic by beating the standalone options to ease the payment processes for merchants and affiliate significant data.

Introduction

The payments sector is on the cusp of a substantial spin, especially after the worldwide hit of Covid 19. Digitization plays a key role in the financial lives of people and electronic payments are at the epicenter of this transformation. Payments serve as the steady foundation of our economy while also fostering the growth of digital economies and innovation.

Scanning a QR code to pay for groceries in China, tapping a sales terminal with a cell phone in the US, or sending an SMS to purchase a bus ticket in Turkey are revolutionary payment methods that demonstrate a continuous shift to digital payments even before the pandemic. This shift may ultimately result in a cashless global society.

Integrated Payments

Given the degree to which the payments landscape has evolved across the globe over the last few years (primarily during the Covid-19 pandemic), digitalization is expected to accelerate that pace. The market has a new buzzword - integrated payments.

Integrated payments are the incorporation of payments into commercial software systems allowing businesses to bypass the time-consuming process of manually reconciling transactional data prone to errors.

The introduction of integrated payments has repainted the payment landscape. It improves a point-of-sale system by optimizing existing features and adding new ones. The solution gives a company access to the technology it needs to evolve its operations over time. The technology will elevate the customer experience and eliminate the need to stitch products from multiple vendors to deliver value.

Market and Geographic Overview

An integrated payment system helps to optimize the available features and offers additional benefits to evolve business operations over some time. It is poised to unlock significant growth for various software firms adding a new revenue stream that compliments software as a service (SaaS) offerings.

As per Bain & Company estimates, Integrated payments present a huge market opportunity worth $35 trillion for ISVs to embed the service within their platforms. ISVs represented ~17% of the US merchant acquiring payment volume in 2020 - indicating the likelihood of further market share gains in merchant acquiring and settlement of credit card payments. As per BCG report, the global SMB acquiring landscape is evolved rapidly during 2015-2020.

Globally, ISVs, big tech players, challengers, and other ecosystem participants are expected to weave transactions-related capabilities into innovative offerings; this will intensify the competition in the market but also will pave the way for new collaboration and revenue opportunities.

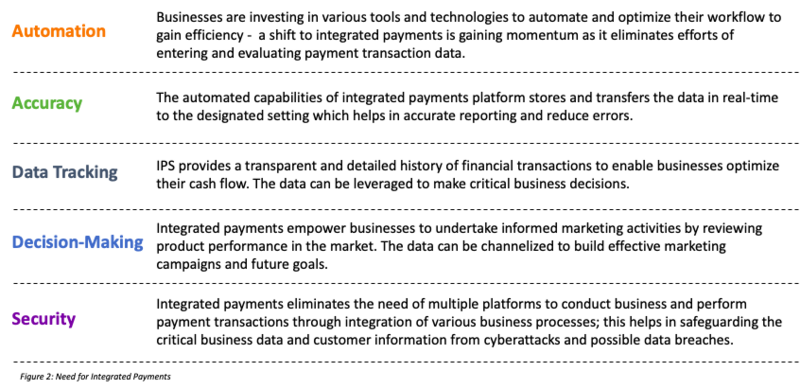

Figure 2 features the drivers that are fueling the adoption of integrated payments across the globe.

Less than one-third of SMBs in the US use integrated software platforms, although, the number is projected to increase significantly as more digital services become part of the platform ecosystem and accessible - this will enable payments companies to introduce offerings for both customers and merchants while exploring new revenue streams and data assets in return. For instance, partnerships such as Square-Afterpay and PayPal-Honey are benefiting from such a combination.

Less than one-third of SMBs in the US use integrated software platforms, although, the number is projected to increase significantly as more digital services become part of the platform ecosystem and accessible - this will enable payments companies to introduce offerings for both customers and merchants while exploring new revenue streams and data assets in return. For instance, partnerships such as Square-Afterpay and PayPal-Honey are benefiting from such a combination.

The emerging trend of collaboration of SaaS providers and payment platforms to develop innovative integrated offerings and address existing pain points has witnessed widespread adoption across the globe. As per reports, SME retailers in the US have a high adoption rate of integrated payments, followed by Europe where it is gaining momentum despite lower penetration in the past. The market is in its nascent stages of development in countries such as Egypt and the UAE.

It has been observed that the number of companies offering integrated payment solutions across the globe has increased significantly since 2020 due to the collaborative efforts of governments and other stakeholders to enhance the payment ecosystem.

ISVs face competition from their clients' various software platforms and traditional banking organizations such as JPMorgan Chase and Goldman Sachs; the traditional institutions are exploring possibilities to remain competitive in this market. The landscape for distribution across the United States and Europe is changing dramatically from being bank-centric to becoming more focused on software partners (ISVs, SaaS, VARs). The integration of payments will require players to commit capital investment in technical infrastructure and employees.

Integrated Payments Models and Role

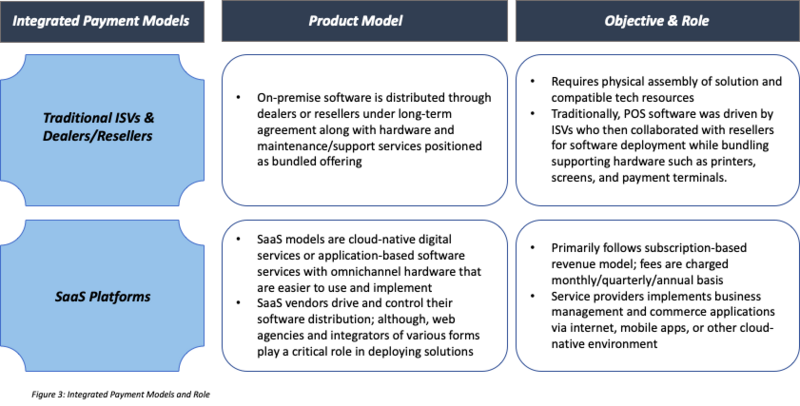

SaaS solutions are quickly replacing this prevalent ISV + reseller software and POS arrangement due to their effectiveness and ease of use.

In a wake of growing digital commerce and the need for integrated payments, software partners have become critical elements for distribution success. The ISV or SaaS channel is considered to be the significant channel for consistent growth for SME payments in the US market for years already. A similar trend has been observed in the UK market in recent years and is now taking shape across Europe.

Merchants are benefitting in various areas including compliance, workflow, and costs from the innovation taking place in the integrated payments market. The below figure highlights the advantages of integrated payments for merchants.

Integrated Payments to Embedded Finance - A Journey of Financial Inclusion

Embedded finance involves incorporating payments directly into applications, platforms, and even invoices which streamlines interactions between buyers and sellers, fundamentally changing how customers use financial products today. Integrated payments are a part of the broader developing trend of embedded finance where companies like Stripe, Unit and Trov are developing an ecosystem of developers and platforms which are expected to gradually incorporate banking, lending, insurance, and other financial products.

Furthermore, it provides a great deal of convenience and simplicity of access, which is impossible to overlook in a world where transactions are progressively becoming digital. Consumers or end-users are the primary benefactors of integrated finance since it provides them with a plethora of inexpensive, customized, and easy-to-access financial services.

With embedded finance at the center, a single pane is expected to be curated where customers will be covered from all financial aspects. It is becoming imperative for businesses to adopt and implement integrated payments into their businesses to maintain attractiveness in the market and promote financial inclusion to tap into the underserved market. As companies across the globe build up the firepower to gain the biggest slice of the integrated payments market, the market is expected to witness buyouts, innovation, and collaboration.